The tax man dines at Kenya’s Java House

My favourite Java House is at Wilson Airport, a haven for calming my nerves before the perilous flying-coffin journeys to the Kenyan coast or savannah[1]. Java House, Kenya’s tastier answer to Starbucks, operates over 80 branches in East Africa, including a smattering in neighbouring Rwanda and Uganda. This proudly Kenyan brand, however, has primarily been backed by foreign investors, including ECP and Abraaj. This week, one of these investors was in court, over a quintessential emerging markets dispute: allegedly unpaid taxes. This matters because of the tension between attracting investment for development, and making sure locals benefit from it.

Foreign investment is often desirable because it can create jobs and provide valuable services, so much so that many countries offer lucrative tax breaks and incentives to lure investors. However, if a foreign company makes a lot of money and never pays tax, while its local employees pay income tax on their earnings, people may start to question how fair this is, and whether their investment really is making the country better off as a whole. If a country reneges on its original incentive agreements once an investment has been made, perhaps in order to please voters, this might deter investors in future.

The transaction that drew the ire of the Kenyan Revenue Authority, its tax body, is ECP’s sale of Java House to Abraaj in 2017. Business Daily Africa reported yesterday that ECP had lost a four-year battle to reduce its tax bill on the sale of Java House. The Kenyan Government believes that ECP owes ~$6 million in taxes (including interest), revised down from a $24 million claim in 2021. ECP, however, has calculated a bill less than 2% of the size: just $0.1 million.

The Kenyan Government’s argument is that corporate income tax is due on the proceeds of the sale, at a rate of 30%. While their first calculation in 2021 seems blatantly wrong, a flat charge on the whole sale value and not just the proceeds, their latest math implies a sale profit of KSH 1.8 billion[2] (~$17 million in 2017). While the business was sold from an offshore entity, and potentially not subject to Kenyan income tax, they argue that discretionary control was exercised through ECP’s Kenyan entity and thus it cannot be considered an offshore disposal. This is similar to EU regulation which requires “substantial presence” to justify offshore ownership for tax purposes, and is the reason why some private equity firms have armies of staff based in Luxembourg.

This makes ECP’s counter-claim surprising on its surface. Their proposed tax on proceeds from the sale would imply a profit of just ~KSH 35 million at the corporate income tax rate, or $0.3 million in 2017, much less than the KSH 1.8 billion reported. On a sale value of KSH 9.5 billion, this would imply a 0.3% gain from sale. This seems low even by Africa private equity standards (the government’s calculated profits are a 23% gain), especially as the sale was lauded by the press at the time.

ECP may believe they should be taxed at the capital gains rate, 15%, instead of the corporate income tax rate. This would make sense, given it is the sale of property or an asset, and not the operations of a business. This would halve their tax bill, however, not reduce it by 50-fold.

The government’s estimate also excludes the impact of any investments beyond the original deal, which may reduce profits. Given the size of Java House in ECP’s Africa Fund III though, additional drawdowns seem unlikely. Its purchase price represented ~15% of the $613 million fund and might have risked over-concentration in one deal with further investment.

The discrepancy may be one of exchange rates: in dollar terms, ECP’s profits were ~$1 million, or just a 1% gain, which matters for their predominantly foreign investor base that includes the International Finance Corporation and the UK government.

Whatever the validity of either side’s arguments, this ruling has the potential to discourage investors, depriving Kenya of the benefits of private sector development. Java House has generated thousands of jobs and serves delighted customers every day. Kenya is well-known as one of the more investor-friendly countries in Africa. Arbitrary tax bills might scare away future investors who could otherwise support Kenya’s growth.

Simultaneously, Kenya has been under pressure from the IMF to raise tax revenues, even as reports emerged that the tax increases were making some vulnerable Kenyans poorer. It makes sense that they would pursue foreign investors who they believe have not paid their fair share of taxes, if they are cracking down on locals as well.

While ECP’s 2021 tax bill from the KRA sounds frustrating and misinformed, foreign investors should pay tax on their profits, if that is the law of the country in which they choose to invest. Tax revenue supports more than just the individuals employed by any one business, contributing to infrastructure, social support, criminal justice and healthcare. Without all the details, the latest outcome seems reasonable and not inconsistent with Kenya’s tax law or investment conditions. It would be a shame if Kenya enforcing its tax code for the benefit of its citizens, as any European country would do, is enough to put off foreign investors in future.

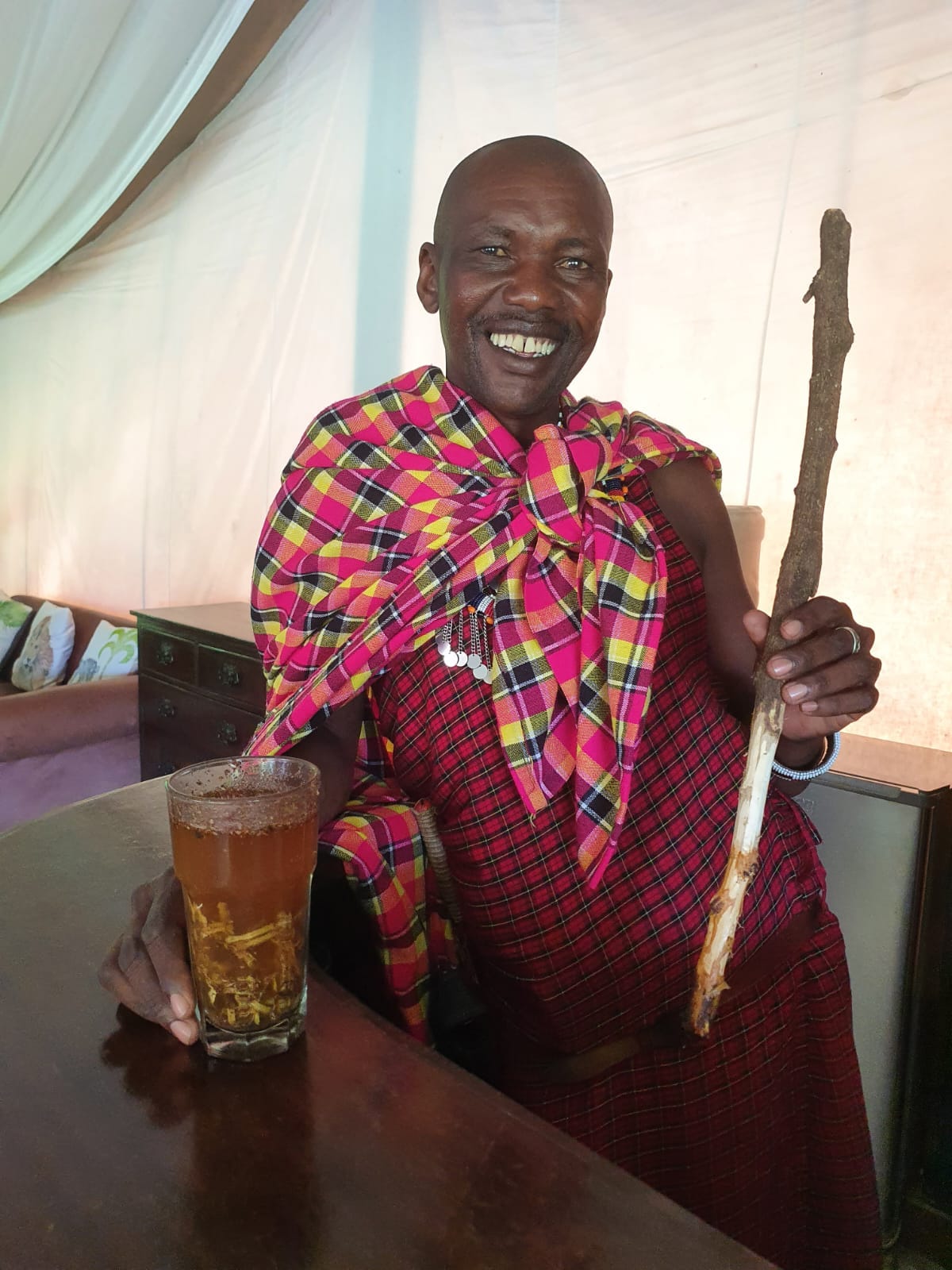

[1] Though beware the chicken samosas. These gave my travel companion a distressing case of food poisoning, only alleviated by the bush medicine of our Maasai guide.

[2] Of the $6 million tax bill (KSH 778 million), KSH 530 million is from the original corporate income tax bill. Dividing this by 30% gives the original assumed profit from sale.