Splitting a mortgage unequally can harm your investment returns

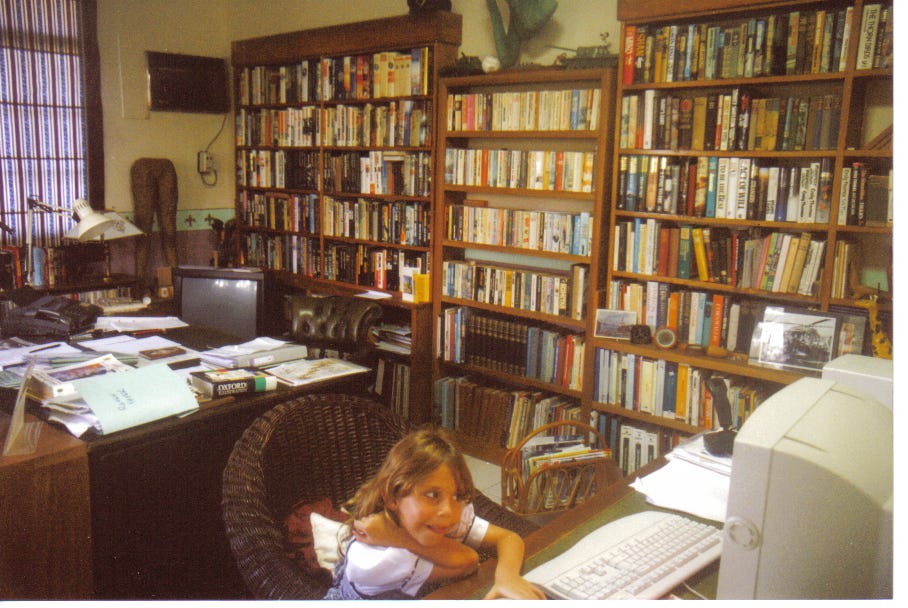

I’ve been building Excel models since I was around 8 years old. My first “reps” as a modeller came from calculating the returns from real estate investments in my father’s study. “You introduced him to Excel and explained how to complete a spreadsheet for our tax returns, as he was doing it in Microsoft Word,” my mother recalls.

Two decades on, and it is my brother’s turn to buy a house. As we are considering co-investing, of course, I had to build a model. There are many guides on how to co-fund a personal mortgage investment, but what surprised me is how little they discuss the implications of leverage on returns.

The two primary financial decisions for co-investment are how to split the deposit and mortgage, which can be challenging to think through.

When taking on a mortgage, you own a percentage of the property and repay the bank over time. In the beginning, you increase your ownership stake by very little, as much of your mortgage payment is interest. Once you own more of your property, proportionally more of your mortgage payment is going towards increasing your ownership stake.

If you split the deposit and mortgage payments equally, once the property is sold, you each will keep 50% of the proceeds. If you have a 90% mortgage, you both have the same ‘leverage’, i.e. the proportion of debt in the investment is the same for both parties. However, if one buyer has a higher ability to pay upfront, you may choose to split the deposit and mortgage payments unequally and your leverage might look different. This matters because of how it affects ownership and returns.

The Guardian published a Q&A that illustrates the confusion well. RY says:

“The property value is £270,000 and we are both responsible for half of the mortgage (£135,000 each) [and implying 50/50 ownership]. My friend's deposit is £70,000, leaving her a £65,000 share of the mortgage. My deposit is £20,000, leaving me a £115,000 part of the mortgage.”

The columnist responds:

“If you intend to buy a property costing £270,000 and your friend has a deposit of £70,000 and yours is £20,000, you'll need a joint mortgage of … £180,000. If you split payment of the mortgage equally, your contribution to the purchase of the house will be £110,000 (ie £20,000 plus £90,000), which means your share of the property should be 40%.”

Is RY right, or the columnist?

In the first example above, RY implies that they each own 50% of the property because they each put up equal ‘capital’ for the house of £135k (albeit with different leverage levels - 48% debt for the friend and 85% debt for RY). This is a valid approach, but unless they keep track of how much of their mortgage they are each paying down, it would be unfair for them to simply split the proceeds from a sale 50/50, because the monthly payments are calculated using a total blended leverage of 67%.

With a 5% interest and a 25-year mortgage, in their first year they would be paying £9,000 of interest and £3,771 of repayments on the property[1]. Yet, given that the friend is borrowing just £65,000, their interest payments should only be £3,250 in that year. The balance of their annual mortgage payment, £3,136, would be in buying back their stake in the property, meaning they would pay down their mortgage far faster. This might not be a problem if they plan to sell their property in 3 years, but if the sale is delayed, they could end up paying off their mortgage completely and subsidising RY’s payments.

In the second example, the columnist assumes the pair split the debt equally, rather than the overall capital for the house. Under this structure, there are fewer complications around how to allocate the share of the property paid down over time, as they pay the same amount of interest on their portion of the debt. Yet RY is still levered at a higher rate than their friend.

Where I see an issue in negotiating the split of deposit and mortgage payments is in estimating your investment returns, given your leverage.

Residential property investment is interesting because it offers extremely high leverage to a retail investor, for fairly low risk[2]. If property prices rise by ~10% per year, and each party is paying ~5% cost of debt, the returns on their equity will differ depending on how much they put in. If you contributed 25% of the capital as equity, then you would expect 25% return in the above construct (5% interest x 75% debt share + 25% equity return x 25% equity share = 10% overall return)[3]. Contributing just 15% of equity to total capital leads to outsize equity returns of 38%, while a 50/50 debt and equity split implies 15% equity returns.

In a real estate environment with high interest rates and low property price growth, leverage matters a lot. Currently, interest rates in the UK for mortgages are ~5% and the Cornish annual property price growth in the past 5 years was 5.6% as of April 2024.

As I think through the investment, I am weighing it against alternatives. I can earn ~4-5% by investing in safe government bonds, or ~10% by investing in the stock market, neither of which are leveraged investments[4].

The implication for co-investing is that I would earn a lower return than my alternatives if I only provided capital up-front. If I do not contribute a portion of the ongoing mortgage payments, my leverage would be non-existent. At this average house price growth rate, investing in Cornish property at a rate of 100% equity looks a lot more like a debt investment in its returns, without any downside protection. At current interest rates, I would need to invest in Cornish property at ~85-90% leverage for it to approach the same returns as the stock market[5].

All that said, personal property investment is also an emotional decision, especially with family, and it’s possible I am over-thinking it. It provides security and stability, and can make someone feel more at home in their living space, which is difficult to quantify as an investment. Yet I found it striking that the guides on how to split mortgages did not include a discussion on the trade-offs for leverage-driven returns, when it is such a big part of how you make money from investing in real estate.

[1] Mortgages are calculated using a fixed monthly payment formula that is equal over their lifetime, rather than a fixed ‘amortisation’ formula which would have the same amount of the principal paid down in each period and lead to higher payments up-front.

[2] Unless of course there is a significant property downturn and no ability to ride it out.

[3] This is a stylised form of the Weighted Average Cost of Capital calculation, though ignores some nuances, for example tax rates (though in this case there is no tax deduction allowed) and the impact of fixed monthly payments, where you pay a portion of principal as well as interest.

[4] I’m referring to my own leverage, often called ‘buying on margin’. The companies themselves usually are levered.

[5] I have not accounted for risk-adjusted returns.